445 Park Avenue, Suite 2001

New York, New York 10022_________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 29, 2015_________________________

NOTICE IS HEREBY GIVEN that

Dear Stockholder:

You are cordially invited to attend the

2016 Annual Meeting of Stockholders

(the “2016 Annual Meeting”) of

TRANS-LUX CORPORATIONTrans-Lux Corporation, a Delaware corporation (the

“Corporation” or the “Company”)

will, to be held

on July 11, 2016, beginning at 10:00 a.m. local time, at Olshan Frome Wolosky LLP, located at

Park1325 Avenue

Tower, 65 East 55th Street,of the Americas, New York,

NY 10022, on June 29, 2015New York 10019 and at

11:00 A.M. local time for the following purposes:

1.

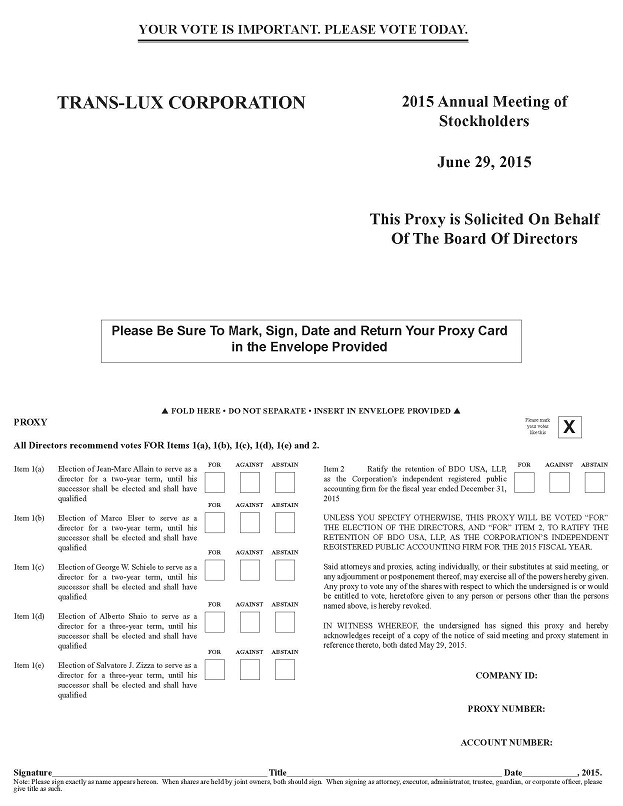

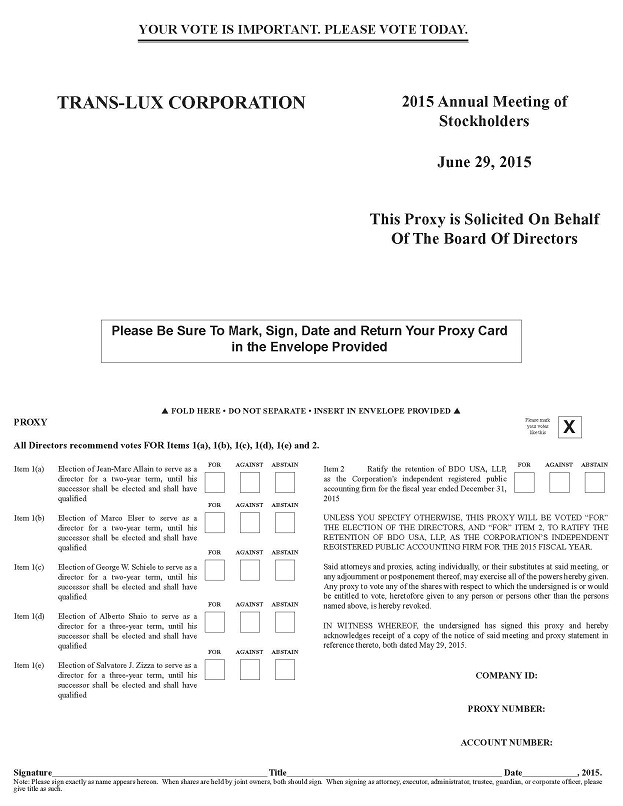

To elect three directors to serve for a term of two years and elect two directors to serve for a term of three years; in each case until their respective successors shall have been duly elected and qualified, namely (a) Jean-Marc Allain, (b) Marco Elser and (c) George W. Schiele, respectively, for a term of two years, and (d) Alberto Shaio and (e) Salvatore J. Zizza, respectively, for a term of three years;

2.

To ratify the appointment of BDO USA, LLP, as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and

3.

To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Proxy materials, which include a Notice of the Meeting, proxy statement and proxy card, are enclosed with this letter. The enclosed proxy statement is first being mailed to the Company’s stockholders on or about June [__], 2016. We also have enclosed our 2015 Annual Report on Form 10-K.

At the 2016 Annual Meeting, you will be asked to consider and vote on:

| 1. | the election of the three nominees named in the accompanying proxy statement to serve as directors until the 2019 Annual Meeting of Stockholders or until the election and qualification of their successors, or their earlier death, resignation or removal; |

| 2. | the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s “blank check” preferred stock, par value $0.001 per share, that it may issue from 500,000 shares to 2,000,000 shares, to be designated in such series or class as the board of directors of the Company shall determine; |

| 3. | the approval of a non-binding advisory resolution to approve the compensation of the Company’s named executive officers; |

| 4. | the ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; and |

| 5. | the transaction of any other business that may properly come before the 2016 Annual Meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on May

21, 2015 has been fixed as27, 2016 are entitled to vote at the

record date2016 Annual Meeting. A list of stockholders entitled to vote at the 2016 Annual Meeting will be available for

the determinationinspection at our executive offices. The presence, in person or by proxy, of the

stockholders holders of a majority of the issued and outstanding shares of common stock entitled to notice of, and to vote at, the meeting, is required for a quorum to transact business.

Your vote is important to us and to our business. Whether or not you plan to attend the 2016 Annual Meeting.Meeting, we hope that you will vote as soon as possible. You may vote in person by ballot at the 2016 Annual Meeting, over the Internet, by telephone or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction form. If you would like to attend and your stock is not registered in your own name, please ask the broker, trust, bank or other nominee that holds the stock to provide you with evidence of your stock ownership.

We appreciate your continued support of the Company and look forward to either greeting you personally at the meeting or receiving your proxy.

| Sincerely, |

| By Order of the Board of Directors,

|

| |

| Robert J. Conologue

Corporate Secretary |

| Senior Vice President and Chief Financial Officer |

| Trans-Lux Corporation |

Dated and Mailed:

New York, New York

May 29, 2015

June [__], 2016

|

Please mark,

IMPORTANT Whether or not you attend the meeting in person, please vote by telephone or Internet, or, if you receive a paper copy of the proxy materials, please sign, date sign and return promptly mail the enclosed proxy so that your shares may be represented atcard or use the Annual Meeting. A return envelope, which requires no postage if mailed intelephone or Internet voting procedures described on the United States, is enclosedproxy card. The proxy statement and annual report are also available for your convenience.review at http://proxystatements.trans-lux.com/. |

TABLE OF CONTENTS

Page

TRANS-LUX CORPORATION

445 Park Avenue, Suite 2001

New York, New York 10022

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 11, 2016

The Board of

TRANS-LUX CORPORATION Directors (the “Board”) of Trans-Lux Corporation, a Delaware corporation (“we,” “our,” “Trans-Lux” or the “Company”), is furnishing this proxy statement for

use at the

2016 Annual Meeting of Stockholders

To Be Held on June 29, 2015_________________________Introduction

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of TRANS-LUX CORPORATION (the “Corporation” or the “Company”) of proxies in the accompanying form to be used at the“2016 Annual Meeting of the Stockholders of the CorporationMeeting”) to be held on Monday, June 29, 2015 (the “Meeting”),Wednesday, July 11, 2016, and at any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice ofthereof. The Annual Meeting. This Proxy Statement and the proxies solicited hereby are being mailed to stockholders on May 29, 2015. The shares represented by the proxies timely received and properly executed pursuant to the solicitation made hereby and not revoked will be voted at the Meeting.

Meeting of Stockholders

The Meeting will be held at 10:00 a.m. local time at Olshan Frome Wolosky LLP, located at Park1325 Avenue Tower, 65 East 55th Street,of the Americas, New York, NY 10022,New York 10019. This proxy statement and accompanying proxy card and our 2015 Annual Report on Form 10-K (the “2015 Annual Report”) will be made available to our stockholders on or about June 29, 2015[__], 2016.

Who Can Vote. Record holders of our common stock, par value $0.001 per share (the “Common Stock”) at 11:00 A.M. local time.Purposes of the Meeting

The purposes of the Meeting are to vote upon: (1) the election of three directors to serve for a term of two years and the election of two directors to serve for a term of three years, in each case until their respective successors shall have been duly elected and qualified, namely (a) Jean-Marc Allain, (b) Marco Elser and (c) George W. Schiele, respectively, for a term of two years, and (d) Alberto Shaio and (e) Salvatore Zizza, respectively, for a term of three years; (2) the ratification of the appointment of BDO USA, LLP, as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and (3) to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof.

Record Date and Voting

The close of business on May 21, 2015 has been fixed as the record date (the “Record Date”) for the determination of the stockholders entitled to notice of and to vote at the Meeting. There were outstanding as of the close of business on May 21, 2015 and27, 2016 (the “Record Date”), are entitled to notice of and to vote at the Meeting, approximately 1,685,085 shares of Common Stock, $0.001 par value of the Corporation ("Common Stock"). Each outstanding share of Common Stock is entitled to one vote on all matters voted on at the Meeting.

Voting Required

Only stockholders of record of the Common Stock as ofvote. At the close of business on the Record Date, [1,710,671] shares of Common Stock were issued and outstanding. Each share of Common Stock owned on the Record Date is entitled to one vote. In addition, the holders of our Series B Convertible Preferred Stock could vote an additional 330,240 votes. Each share of the Series B Convertible Preferred Stock is entitled to twenty (20) votes per share.

Quorum. A quorum will be entitledpresent at the 2016 Annual Meeting if the holders of a majority of the eligible shares as of the Record Date are present in person or by proxy. With respect to Proposal 2, the holders of the shares of Common Stock vote as a separate class and the holders of the Series B Convertible Preferred Stock vote as a separate class. A majority of the outstanding shares of Common Stock as a separate class and a majority of the outstanding shares of the Series B Convertible Preferred Stock as a separate class, in each case present in person or by proxy, constitutes a quorum. Shares of Common Stock and Series B Convertible Preferred Stock that are represented by a proxy marked “withhold” or “abstain” will be considered present at the 2016 Annual Meeting for purposes of determining a quorum.

How to Vote. If your shares are held in a brokerage account, by a trustee or by another nominee (typically referred to as being held in “street name”), you may receive a separate voting instruction form with this proxy statement, or you may need to contact your broker, bank or other stockholder of record to determine whether you will be able to vote electronically via the Internet or by telephone.

If you are a stockholder of record, you may vote in person at the 2016 Annual Meeting or by proxy without attending the 2016 Annual Meeting. You may vote by proxy in one of three convenient ways:

By mail: sign, date and return the proxy card in the enclosed prepaid envelope;

By Internet: visit the website shown on your proxy card and follow the instructions; or

By telephone: call the toll-free telephone number shown on your proxy card and follow the instructions.

If you sign and return the enclosed proxy card but do not indicate your vote, the designated proxy holders will vote your shares in accordance with the recommendations of the Board as follows: “FOR” each of the nominees for election as directors; “FOR” the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of shares of “blank check” preferred stock that the Company can issue from 500,000 shares to 2,000,000 shares (the “Blank Check Preferred Stock Proposal”); “FOR” the approval of a non-binding advisory resolution to approve the compensation of the Company’s named executive officers; and “FOR” the ratification of the appointment of Marcum LLP as our independent registered public accounting firm. We are not aware of any other business to be acted upon at the 2016 Annual Meeting other than as set forth herein. If you grant a proxy, the persons named as proxy holders will have the discretion to vote your shares on any additional matters properly presented for a vote at the

2016 Annual Meeting.

A

If your shares are held in a brokerage account, by a trustee or by another nominee, you are considered the “beneficial owner” of those shares. As the beneficial owner of those shares, you have the right to direct your broker, trustee or nominee how to vote and you also are invited to attend the 2016 Annual Meeting. However, because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the 2016 Annual Meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the 2016 Annual Meeting.

Vote Required to Adopt Proposals.

Proposal 1: Election of Directors. Directors are elected by a plurality of the votes cast at the 2016 Annual Meeting, either in person or by proxy. The three nominees receiving the greatest number of votes at this Annual Meeting will be elected to our Board, even if they receive less than a majority of such shares. Broker non-votes and abstentions will not be counted in determining the number of votes cast and will have no effect on the election of directors.

Proposal 2: Blank Check Preferred Stock Proposal. The affirmative vote of the holders of a majority of the outstanding shares of the Common Stock as a separate and distinct class, whether in person or by proxy, as well as the affirmative vote of a majority of the voting power of allthe outstanding shares of the Common Stock and Series B Convertible Preferred Stock voting together as one class and on an as-converted basis, as well as the affirmative vote of a majority of the shares of Series B Convertible Preferred Stock outstanding must be present or represented by proxyvoting as a separate and distinct class, at the 2016 Annual Meeting to constitute a quorum. Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Meeting. If a quorum is not present, the Meeting may be adjournedrequired to a subsequent date for the purpose of obtaining a quorum.

On May 22, 2015, the Board of Directors of the Corporation unanimously adopted resolutions approving, declaring advisable and recommendingapprove an amendment to the Corporation’s stockholdersCompany’s Amended and Restated Certificate of Incorporation to effect an increase in the adoptionnumber of eachshares of “blank check” preferred stock, par value $0.001 per share, from 500,000 shares to 2,000,000 shares that can be issued. Broker non-votes and abstentions, if any, will have the Proposals.

effect of votes “AGAINST” this proposal.

Proposal Number 1 requires a plurality vote. Proposal Number 2 requires the3: Advisory Vote on Executive Compensation. The affirmative vote of a majority of the votes cast affirmativelyat the 2016 Annual Meeting, either in person or negativelyby proxy, will be required for approval of a non-binding advisory resolution to approve the compensation of the Common Stock.Company’s named executive officers. Broker Non-Votes

If stockholders donon-votes will not give their brokers instructions as to how tobe counted in determining the number of votes cast and will have no effect on the approval of this proposal. Abstentions will have the effect of votes “AGAINST” this proposal.

Proposal 4: Ratification of Independent Registered Public Accounting Firm. The affirmative vote shares held in street name, the brokers have discretionary authority to vote those shares on ‘routine’ matters, such as the ratificationof a majority of the votes cast at the 2016 Annual Meeting, either in person or by proxy, will be required to ratify the selection of our independent registered public accounting firm butat the 2016 Annual Meeting. Broker non-votes, if any, will not be counted in determining the number of votes cast and will have no effect on ‘non-routine’ proposals, such as the electionapproval of directors. As a result,this proposal. Abstentions will have the effect of votes “AGAINST” this proposal.

How Your Shares Will Be Voted if you holdYou do Not Provide Voting Instructions. If your broker holds your shares in street name, andyour broker, as the registered holder, must vote your shares in accordance with your instructions. If you do not provide voting instructions, to your broker yourhas the discretion to vote those shares willwith respect to routine proposals but not be voted on any proposal onwith respect to non-routine proposals. Shares for which your broker does not have discretionary authority to vote. Shares held by brokers who do not have discretionary authority to vote on a particular matter and who have not received votingreceive instructions, from their customerssometimes called “broker non-votes,” will be counted as present for the purpose of determining whether there is a quorum at the Meeting, and will have no effect for the purpose of determining whether our stockholders have approved a matter requiring a majority of votes cast affirmatively or negatively or a plurality vote.Abstentions

Abstentions will not affect the outcome of the vote on the election of Directors, but will have the same effect as a vote “AGAINST” themeeting. The proposal to ratify the appointmentselection of BDO USA, LLP.

Howour independent public accounting firm is considered a routine proposal and accordingly, we do not anticipate broker non-votes in this matter. Broker non-votes will not be included in determining the number of votes cast for this proposal. The proposals for the election of directors and the advisory resolution on compensation of the Company’s named executive officers will not include broker non-votes in determining the number of votes cast for these proposals. The Blank Check Preferred Stock Proposal will include broker non-votes in determining the number of votes cast for such proposal.

What to Votedo if You may own shares either (1) directly in your name, in which case you are the record holder of such shares, or (2) indirectly through a broker, bank or other nominee, in which case such nominee is the record holder. If your shares are registered directly in your name, we are sending these proxy materials directlyWish to you. If the record holder of your shares is a nominee, you will receive proxy materials from such nominee.Change Your Voting Instructions.

If you are a record holder,wish to change or revoke your voting instructions after you have submitted your proxy, you may vote in person at the Meeting or by proxy. We recommend that you vote by proxy even if you plan to attend the Meeting. You can always change your vote at the Meeting. To vote by proxy, mark your proxy card, date and sign it, and return it as soon as possible in the postage-paid envelope provided. If your shares are held by a broker, bank or other nominee, such nominee will provide you with instructions that you must follow in order to have your shares voted. If you plan to attend the Meeting and vote in person, you will need to contact the broker, bank or other nominee to obtain evidence of your ownership of shares on May 21, 2015.Proxies

A stockholder who shall sign and return a proxy in the form enclosed with this statement has the power to revoke itdo so at any time before it is exercised by giving written noticethe proxies are voted at the 2016 Annual Meeting by:

notifying the Corporate Secretary of revocationthe Company in writing at the address on the first page of this proxy statement that you wish to revoke your proxy;

delivering a subsequent proxy bearing a date after the date of the proxy being revoked and relating to the same shares; or a proxy of later date, or by

voting in person at the 2016 Annual Meeting each as more fully described inif you are the following paragraph. Unless otherwise specified, the proxies in the accompanying form will be voted in favorstockholder of all of the proposals set forth in the Notice of Annual Meeting. In the discretion of the proxy holders, the proxies will also be voted for or against such other matters as may properly come before the Meeting. The Board of Directors is not awarerecord.

Please note that

any other matters are to be presented for actionyour attendance at the

Meeting.

Revoking2016 Annual Meeting will not, by itself, revoke your proxy.

If you hold your shares in “street name,” please contact your bank, broker or other nominee for instructions on how to change your voting instructions.

Householding of Proxy Materials. In an effort to reduce printing costs and postage fees, we have adopted a ProxyApractice approved by the Securities and Exchange Commission (the “SEC”) called “householding.” Under this practice, stockholders who have the same address and last name will receive only one copy of our proxy may be revokedmaterials, unless one or more of these stockholders notifies us that he or she wishes to continue receiving individual copies. Stockholders who participate in householding will continue to receive separate proxy cards. If you share an address with another stockholder, received only one set of proxy materials and would like to request a separate paper copy of these materials, please contact our Corporate Secretary by mail at the address on the first page of this proxy statement, by telephone at (800) 243-5544 or by email at rconologue@trans-lux.com, and we will promptly deliver a separate copy. Stockholders sharing an address can request delivery of a written statement to Continental Stock Transfer & Trust, Co., Attention: Proxy Department, via email at: proxy@continentalstock.com or via facsimile at: 212-509-5152. Such revocation must state that thesingle copy of annual reports on Form 10-K and proxy is revoked. A proxy may also be revokedstatements if they are receiving multiple copies of these materials by a subsequent proxy executedcontacting our Chief Financial Officer by the person executing the prior proxy and presentedmail at the Meeting,address on the first page of this proxy statement, by telephone at (800) 243-5544 or by voting in personemail at the Meeting.

Proxyrconologue@trans-lux.com.

We Will Bear Solicitation and ExpensesThe CompanyExpenses.

We will pay forbear the entire cost of soliciting proxies on its behalf. Wesolicitation, including the preparation, assembly, printing and mailing of this proxy statement, the proxy and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will also reimbursebe furnished to brokerage firms, bankshouses, fiduciaries and other agents for the cost of forwarding the Company’s proxy materialscustodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services. How to Request a Copy of the Proxy Materials. For the 2016 Annual Meeting or any future annual meeting of stockholders, if you would like to request a copy of the proxy materials, including the proxy statement and employees may solicit proxies in person,form of proxy and the 2015 Annual Report, please contact our Chief Financial Officer by mail at the address on the first page of this proxy statement, by telephone viaat (800) 243-5544 or by email at rconologue@trans-lux.com, and we will promptly deliver a copy to you. You may also request a paper copy of the internet, press releases or advertisements. Directors and employees will not be paid any additional compensation for soliciting proxies.proxy materials at www.trans-lux.com.

Important Notice Regarding the Availability of Proxy Materials Availablefor the

Stockholder Meeting to be Held on

the InternetTheseJuly 6, 2016

The proxy materialsstatement and the Company’s 20142015 Annual Report on Form 10-K are available on the internet on the following website: at http://proxystatements.trans-lux.com/. ELECTION OF DIRECTORS

Proposal Nos. 1(a), 1(b), 1(c), 1(d)

Pursuant to the Company’s Amended and 1(e) (Items 1(a), 1(b), 1(c), 1(d)Restated Certificate of Incorporation and 1(e) on Proxy Card)TheAmended and Restated Bylaws, the Board of Directors of Trans-Lux Corporation is divided into three separate classes with theof directors. At each Annual Meeting of Stockholders, one class of directors is elected to a term of office of onethree years. Alan K. Greene, Ryan J. Morris and Yaozhong Shi have been nominated by the Board, upon the recommendation of the Nominating Committee, for election as directors at the 2016 Annual Meeting. Those elected will serve a three classesyear term until the 2019 annual meeting of directors expiring each yearstockholders (the “2019 Annual Meeting”) or until the election and with each class being elected for a three-year term.qualification of their successors, or their earlier death, resignation or removal. The BylawsAmended and Restated Certificate of Incorporation of the Corporation allowCompany allows for the Board of Directors to consist of a minimum of five and a maximum of fifteen members. The Company did not hold an annual meeting in 2014. If

Alan K. Greene is a current director who was elected at the Annual Meeting2013 annual meeting of Stockholdersstockholders. Yaozhong Shi is a current director who was selected by the Board to be heldserve as a director on June 29, 2015, (a)2014. Ryan J. Morris is a current director who was selected by the Board to serve as an independent director on April 25, 2016. Two of the nominees, Alan K. Greene and Ryan J. Morris are independent pursuant to the listing requirements of the NYSE MKT Company Guide. There are no family relationships among any of the directors, listed under Class A below will serve until the Annual Meeting of Stockholders in 2017, or until his successor is duly electeddirector nominees and qualified, (b) the directors listed under Class C below will serve until the Annual Meeting of Stockholders in 2018, or until his successor is duly elected and qualified, and (c) the directors listed under Class B below will continueexecutive officers.

Each nominee has agreed to serve

if elected. If a nominee becomes unavailable for election or cannot serve, an event that we do not expect, the

terms to which they were elected untilBoard may substitute another nominee or reduce the

Annual Meetingnumber of

Stockholders in 2016, respectively, or until their successors are duly elected and qualified.Management has no reason to believe that the directors will not be available or will not serve if elected, but if any director should not become available to serve, full discretion is reserved to the persons named as proxies to vote for such other persons as may be nominated. Proxiesnominees. The enclosed proxy will be voted “FOR”for such substitute, if any, as shall be designated by the nominee unless the stockholder specifies otherwise.

Directors Standing for Election

| | | |

Name | Age | Since | Expiration of Proposed Term |

CLASS A | | | |

Jean-Marc (J.M.) Allain | 45 | 2011 | 2017 |

Marco Elser | 56 | 2012 | 2017 |

George W. Schiele | 83 | 2009 | 2017 |

CLASS C | | | |

Alberto Shaio | 66 | 2013 | 2018 |

Salvatore J. Zizza | 69 | 2009 | 2018 |

Directors Whose Term Continues

| | | |

Name | Age | Since | Expiration of Term |

CLASS B | | | |

Alan K. Greene | 75 | 2013 | 2016 |

Yaozhong Shi | 46 | 2014 | 2016 |

Set forth below is a summaryBoard.

Each of the director nominees receiving a plurality of the votes cast at the 2016 Annual Meeting will be elected as a director. You may withhold votes from any or all nominees. Broker non-votes will have no effect on the result of this vote.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE NOMINEES.

Director Qualifications

The following paragraphs provide information as of the date of this proxy statement about each nominee and current director. The information presented includes information each nominee and director has given us about his age, all positions he holds, his principal occupation and business experience for

each of the

persons named abovepast five years and the

primary aspectsnames of

their experience, qualifications, attributesother publicly-held companies for which he currently serves as a director or

skills that led to the conclusion that each individual is qualified to serve on the Board. The members of the Nominating Committee recommended to the Board that each of the directors listed below serve as members of the Board of Directors.DIRECTORS STANDING FOR ELECTION –

CLASS A: Serving a Two-Year Term Expiring 2017

J.M. Allain became the President and CEO of Trans-Lux Corporation on February 16, 2010 and has served as a director since June 2011. Mr. Allain served as President of Panasonic Solutions Company from July 2008 through October 2009; Vice President of Duos Technologies from August 2007 through June 2008; General Manager of Netversant Solutions from October 2004 through June 2005; and Vice President of Adesta, LLC from May 2002 through September 2004. Mr. Allain has familiarity withduring the operational requirements of complex organizations and has experience dealing with reorganizations and turnarounds. Mr. Allain’s experience and deep understanding of the operations of the Corporation allow him to make valuable contributionspast five years. In addition to the Board.

Marco M. Elser has servedinformation presented below regarding each director and director nominee’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he should serve as a director, we also believe that all of Trans-Lux Corporation since May 25, 2012. For over five years, Mr. Elser has beenour director nominees have a partner with AdviCorp Plc, a London-based investment banking firm. Mr. Elser also serves on the Board of Directors of Protalex, a Florham Park, NY based biotechnology company, since 2014. He is a also one of the independent directors of North Hills Signal Processing Corporation, a Long Island, NY based technology company. Mr. Elser previously served as International Vice President of Northeast Securities, managing distressed fundsreputation for family officesintegrity, honesty and small institutions from 1994adherence to 2001; he served as a first Vice President of Merrill Lynch Capital Markets in Romehigh ethical standards. They each have demonstrated business acumen and London until 1994. Mr. Elser was formerly Chairman of the Board of Pine Brook Capital, a Shelton, CT based engineering company and had served in that role for over five years. Mr. Elser was also the president of the Harvard Club of Italy until 2014, an association he founded in 2002 with other Alumni in Italy where he has been living since 1984. He received his BA in Economics from Harvard College in 1981. Mr. Elser’s extensive knowledge of international finance and commerce allows himability to make valuable contributions to the Board.

George W. Schiele has served as a director of Trans-Lux Corporation since 2009. Mr. Schiele was elected Chairman of the Board (a non-executive position) of Trans-Lux Corporation on September 29, 2010. Mr. Schiele currently serves as President of George W. Schiele, Inc., a trust management and private investment company and has held such position since 1974. He is also President of four other private companies since 1999, 2005, 2006 and 2009, respectively; from 2003 until 2013 he was a exercise sound judgment.

Director

of Connecticut Innovations, Inc., one of the nation’s five most active venture capital firms, and was Chairman of its Investment Advisory and Investment Committees from 2004 until 2013, responsible during his tenure for more than 200 VC investments. Mr. Schiele additionally serves as Trustee of seven private trusts since 1974, 1999, 2007, 2009, 2010, 2011 and 2012, respectively, serving as President of one since 2000, and as an Officer and Director of two others. Mr. Schiele also serves as a Trustee to various other private charitable foundations since 2006, as the Managing Partner of two private investment partnerships since 2008, and as a Director and Executive Board member of The Yankee Institute since 2000. Mr. Schiele was initially elected in accordance with a Settlement Agreement approved by the United States District Court for the Southern District of New York described in the Corporation’s proxy statement for the December 11, 2009 Annual Meeting of Stockholders and re-elected by the shareholders at the 2010/2011 Annual Meeting of Stockholders. Mr. Schiele’s long experience in previous start-ups and corporate restructurings and his service to other boards of directors allow him to make valuable contributions to the Board.

DIRECTORS STANDING FOR ELECTION –

CLASS C: Serving a Three-Year Term Expiring 2018

Alberto Shaio became the Chief Operating Officer of Trans-Lux Corporation on October 6, 2014 and has served as a director since October 2, 2013. He also serves on the Board of Advisors of Scorpion Capital. Previously, Mr. Shaio served as President and CEO of Craftsmen Industries from January 1, 2011 through September 1, 2013. Previously he held various posts with Farrel Corporation (Ansonia, CT and Rochdale, England) from 1986 until December 31, 2010, including the role of President and CEO since 2003. Mr. Shaio was a Director of the HF Mixing Group (Germany) from 2002 until 2010. From 1970 through 1986, Mr. Shaio was General Manager, Vice President or President of various companies such as Pavco, Filmtex (Columbia SA), and the Interamerican Investment Group. He has served on the board of directors of New Energy Corporation, Farrel Corporation, Interactive Systems, Polifilm, Filmtex, PAVCO SA, and Harburg Freudenberg Maschinenbau GmbH (Germany). Mr. Shaio’s extensive international experience and service to numerous other boards of directors allow him to provide valuable contributions to the Board.

Salvatore J. ZizzaNominees

Alan K. Greene, 76, has served as an independent director of Trans-Lux Corporation since 2009. Mr. Zizza was elected Vice Chairman of the Board (a non-executive position) of Trans-Lux Corporation on September 29, 2010. Mr. Zizza has previously served as Chief Executive Officer and Chairman of the Board of General Employment Enterprises Inc. from December 23, 2009 until December 26, 2012. Mr. Zizza had served as President and Chief Operating Officer of Bion Environmental Technologies Inc. from January 13, 2003 until December 31, 2005, and has served as Non Executive Chairman of Harbor BioSciences, Inc. since March 27, 2009. He currently serves as the Chairman of Zizza & Associates, LLC. Mr. Zizza serves as Chairman of Metropolitan Paper Recycling Inc. and as the Chairman of Bethlehem Advanced Materials. Additionally, Mr. Zizza serves as a Director of GAMCO Westwood Funds. He has been an Independent Trustee of GAMCO Global Gold, Natural Resources & Income Trust by Gabelli since November 2005 and serves as a Director/trustee of 26 funds in the fund complex of Gabelli Funds. He has been Director of General Employment Enterprises Inc. since January 8, 2010 and has been an Independent Trustee of Gabelli Dividend & Income Trust since 2003. Mr. Zizza has been Independent Director of Gabelli Convertible & Income Securities Fund Inc. since April 24, 1991 and has been a Director of Gabelli Equity Trust, Inc. since 1986 and a Trustee of Gabelli Utility Trust since 1999. He served as Lead Independent Director of Hollis-Eden Pharmaceuticals from March 2006 to March 2009 and as a Director of Earl Scheib Inc. from March 1, 2004 to April 2009. Mr. Zizza was initially elected in accordance with a Settlement Agreement approved by the United States District Court for the Southern District of New York described in the Corporation’s proxy statement for the December 11, 2009 Annual Meeting of Stockholders and re-elected by shareholders at the 2012 Annual Meeting of Shareholders. Mr. Zizza received his Bachelor of Arts in Political Science and his Master of Business Administration in Finance from St. John's University, which also has awarded him an Honorary Doctorate in Commercial Sciences. Mr. Zizza’s extensive experience and service to numerous other boards of directors allow him to provide valuable contributions to the Board. In addition, Mr. Zizza also serves as Chairman of the Audit Committee and is the “audit committee financial expert” as required under the rules of the United States Securities and Exchange Commission (the “SEC”).

DIRECTORS – CLASS B: Serving a Three-Year Term Expiring 2016

Alan K. Greene has served as an independent director of Trans-Lux Corporation since October 2, 2013. Mr. Greene has previously served as a Partner of Price Waterhouse from 1974 to 1995, acting at various times as Managing Partner for cross border transactions and as National Director of tax services for M&A, and in connection with foreign banks and mutual funds with respect to acquisition and investment strategies. Currently, Mr. Greene serves on the board of directors of Intellicorp, Inc. (since 2001) and RAVE, Inc. (since 2005). Previously, he was a director of Connecticut Innovations, Inc. from 2005 until 2015, the Connecticut Clean Energy Fund from 2007 until 2011, Metromedia International Group, Inc. from 2007 until 2011, Enduro Medical Technologies LLC from 2005 until 2013 and Greene Rees Technologies, LLC from 1995 until 2013. Mr. Greene has also held prior board positions at Fortistar Capital, Oswego Hydro, Access Shipping and various other public and private companies through the years. Mr. Greene’s experience serving as chairman of various audit committees of many of these organizations and strong aptitude for technologies allow him to provide valuable contributions to the Board.

Ryan J. Morris, 36, was appointed as an independent director on April 25, 2016. Mr. Morris serves as President of Meson Capital Partners LLC, a San Francisco-based investment partnership, which he founded in February 2009. Mr. Morris currently serves on the board of directors of InfuSystem Holdings, Inc. since April 2012 (and served as Executive Chairman from April 2012 to May 2015) and Sevcon, Inc. since December 2013. Previously, Mr. Morris served as a director of Lucas Energy, Inc. from October 2012 to October 2014 (and was Chairman of the Board from December 2012 to November 2013). From June 2011 to July 2012, Mr. Morris served as a member of the equity committee of HearUSA, Inc., responsible for maximizing value to the stockholders. Mr. Morris’ extensive knowledge of finance and his service to other boards of directors allow him to make valuable contributions to the Board.

Yaozhong Shi, 47, has served as a director of Trans-Lux Corporation since June 29, 2014. Mr. Shi was appointed as a director of Trans-Lux Corporationthe Company pursuant to the terms of that certain Securities Purchase.

Purchase Agreement dated as of June 27, 2014 between the Company and Retop Industrial (Hong Kong) Limited.Transtech LED Company Limited (“Transtech”). Mr. Shi has served as a Directorbeen an employee of Retop LED Display Co. Ltd.the Company since April 2005 and Director of Retop Lighting Landscape Design Engineering Co., Ltd. since April 2013.July 2015. Mr. Shi has also served as a Vice Presidentover 25 years of Elec-Tech International Co., Ltd. since July 2009. Previously, Mr. Shi served as General Manager and President of Retop Opto Electronic Co. Ltd. from January 2000 through March 2005.experience in the LED industry. Mr. Shi’s contributions to RetopTranstech have resulted in a successful, well-known brand in the LED display total solution industry that provides solutions for multiple indoor & outdoor applications primarily in the media, entertainment and sports sectors. Mr. Shi’s strong business knowledge and extensive history and resources in the LED display arena combined with his twenty years of experience in the LED industry, allow him to provide valuable contributions to the Board.

THE BOARD OF DIRECTORS RECOMMENDS A

VOTE “FOR” THE APPROVAL OF EACH OF THE DIRECTORS

STANDING FOR ELECTION LISTED ABOVE.

IT IS INTENDED THAT PROXIES SOLICITED HEREBY WILL BE

VOTED “FOR” EACH OF THE DIRECTOR NOMINEES UNLESS

THE STOCKHOLDER SPECIFIES OTHERWISE.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Proposal No. 2 (Item 2

Other Company Directors

J.M. Allain, 46, became the President and CEO of the Company on Proxy Card)BackgroundFebruary 16, 2010 and Ratification Requirement

BDO USA, LLP (“BDO”) has served as our independent registered public accounting firma director since June 2011. Mr. Allain served as President of Panasonic Solutions Company from July 2008 through October 2009; Vice President of Duos Technologies from August 2007 through June 2008; General Manager of Netversant Solutions from October 2004 through June 2005; and Vice President of Adesta, LLC from May 2002 through September 2004. Mr. Allain has familiarity with the operational requirements of complex organizations and has experience dealing with reorganizations and turnarounds. Mr. Allain’s experience and deep understanding of the operations of the Company allow him to make valuable contributions to the Board.

Marco M. Elser, 57, has served as a director since May 17,25, 2012. Since 2015, Mr. Elser currently serves as a partner with Lonsin Capital, a London-based investment banking firm. Mr. Elser also serves on the Board of Directors of Protalex, a Florham Park, NY-based biotechnology company, since 2014. He is also one of the independent directors of North Hills Signal Processing Corporation, a Long Island, NY based technology company. Mr. Elser previously had been a partner with AdviCorp Plc, a London-based investment banking firm; served as International Vice President of Northeast Securities, managing distressed funds for family offices and small institutions from 1994 to 2001; and served as a first Vice President of Merrill Lynch Capital Markets in Rome and London until 1994. Mr. Elser was formerly Chairman of the Board of Pine Brook Capital, a Shelton, CT based engineering company. Mr. Elser was also the president of the Harvard Club of Italy until 2014, an association he founded in 2002 with other Alumni in Italy where he has been living since 1984. He received his BA in Economics from Harvard College in 1981. Mr. Elser’s extensive knowledge of international finance and commerce allows him to make valuable contributions to the Board.

George W. Schiele, 84, has served as a director since 2009. Mr. Schiele was elected Chairman of the Board (a non-executive position) of the Company on September 29, 2010. Mr. Schiele currently serves as President of George W. Schiele, Inc., a trust management and private investment company and has held such position since 1974. He is also President of four other private companies; from 2003 until 2013 he was a Director of Connecticut Innovations, Inc., one of the nation’s five most active venture capital firms, and was Chairman of its Investment Advisory and Investment Committees from 2004 until 2013, responsible during his tenure for more than 200 VC investments. Mr. Schiele additionally serves as Trustee of ten private trusts since 1974 through the present. Mr. Schiele serves as an officer of two charitable foundations since 2006 and is Managing Partner of two investment partnerships since 2008, and as a Director of The Yankee Institute since 1998. Mr. Schiele’s long experience in previous start-ups and corporate restructurings and his service to other boards of directors allow him to make valuable contributions to the Board.

Alberto Shaio, 68, became the Chief Operating Officer of the Company on October 6, 2014 and has served as a director since October 2, 2013. He also serves on the Board of Advisors of Scorpion Capital. Previously, Mr. Shaio served as President and CEO of Craftsmen Industries from January 1, 2011 through September 1, 2013. Previously he held various posts with Farrel Corporation (Ansonia CT and Rochdale England) from 1986 until December 31, 2010, whenincluding the role of President and CEO since 2003. Mr. Shaio was a Director of the HF Mixing Group (Germany) from 2002 until 2010. From 1970 through 1986, Mr. Shaio was General Manager, Vice President or President of various companies such as Pavco, Filmtex (Columbia SA), and the Interamerican Investment Group. He has served on the board of directors of New Energy Corporation, Farrel Corporation, Interactive Systems, Polifilm, Filmtex, PAVCO SA, and Harburg Freudenberg Maschinenbau GmbH (Germany). Mr. Shaio’s extensive international experience and service to numerous other boards of directors allow him to provide valuable contributions to the Board.

Salvatore J. Zizza, 70, has served as an independent director since 2009. Mr. Zizza was elected Vice Chairman of the Board (a non-executive position) of the Company on September 29, 2010. Mr. Zizza has previously served as Chief Executive Officer and Chairman of the Board of General Employment Enterprises Inc. from December 23, 2009 until December 26, 2012. Mr. Zizza had served as President and Chief Operating Officer of Bion Environmental Technologies Inc. from January 13, 2003 until December 31, 2005, and has served as Non Executive Chairman of Harbor BioSciences, Inc. since March 27, 2009. He currently serves as the Chairman of Zizza & Associates, LLC. Mr. Zizza serves as the Chairman of Bethlehem Advanced Materials. Additionally, Mr. Zizza serves as a Director of GAMCO Westwood Funds. He has been an Independent Trustee of GAMCO Global Gold, Natural Resources & Income Trust by Gabelli since November 2005 and serves as a Director/trustee of 26 funds in the fund complex of Gabelli Funds. He has been Director of General Employment Enterprises Inc. since January 8, 2010 and has been an Independent Trustee of Gabelli Dividend & Income Trust since 2003. Mr. Zizza has been Independent Director of Gabelli Convertible & Income Securities Fund Inc. since April 24, 1991 and has been a Director of Gabelli Equity Trust, Inc. since 1986 and a Trustee of Gabelli Utility Trust since 1999. He served as Lead Independent Director of Hollis-Eden Pharmaceuticals from March 2006 to March 2009 and as a Director of Earl Scheib Inc. from March 1, 2004 to April 2009. As previously disclosed in the Company’s Prospectus filed on October 14, 2015, the SEC issued a cease and desist order which provides that Mr. Zizza violated Rule 13b2.2 of the Securities Exchange Act of 1934 and in connection therewith Mr. Zizza agreed to pay a $150,000 fine. Mr. Zizza received his Bachelor of Arts in Political Science and his Master of Business Administration in Finance from St. John's University, which also has awarded him an Honorary Doctorate in Commercial Sciences. Mr. Zizza’s extensive experience and service to numerous other boards of directors allow him to provide valuable contributions to the Board. In addition, Mr. Zizza also serves as Chairman of the Audit Committee and is the “audit committee financial expert” as required under the rules of the Corporation’s SEC.

CORPORATE GOVERNANCE AND RELATED MATTERS Board of Directors approved their engagement to audit

Board Composition and Election of Directors

We operate under the Corporation’s financial statementsdirection of our Board. Our Board is responsible for the fiscal year ended December 31, 2010. The Audit Committee has appointed BDO asmanagement of our independent registered public accounting firm forbusiness and affairs. Our Certificate of Incorporation provides that the fiscal year ending December 31, 2015.The ratificationnumber of the appointmentdirectors may be determined pursuant to our Amended and Restated Bylaws, which provide that such number may be determined from time to time by our Audit Committee of BDO asBoard. However, under our independent registered public accounting firm forAmended and Restated Bylaws, the fiscal year ending December 31, 2015 requires the affirmative voteBoard shall consist of a majorityminimum of the votes cast affirmatively or negativelyfive and a maximum of Common Stockfifteen directors. Our directors are divided into three separate classes of the Corporation voting in person or by proxy. Although stockholder approval of the appointment is not required by law and is not binding on the Audit Committee, the Committee will take the appointment under advisement if such appointment is not approved by the affirmative vote of a majority of the votes cast at the Meeting.

Representatives of BDO may be present at the Annual Meeting to answer appropriate questions and to make a statement if they wish.

The Audit Committee is not aware of any disagreements between management and BDO regarding accounting principles and their application or otherwise.

Audit Committee Pre-Approval of Independent Auditor Services: All audit services provided by BDO for 2014 and 2013 were approved by the Audit Committee in advance of the work being performed.

Audit Fees: BDO audit fees were $183,339 in 2014 and $202,525 in 2013. BDO audit fees for both 2014 and 2013 included, but were not limited to, fees associated with the annual audit of the Corporation’s financial statements, reviews of the Corporation’s quarterly reports on Form 10-Q and reviews of the Corporation’s proxy statements.

Audit-Related Fees: There were no audit-related services provided by BDO in 2014 or in 2013.

Tax Fees: BDO did not provide any tax services during 2014 or in 2013.

All Other Fees: BDO did not provide any non-audit related services during 2014 or in 2013.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE

PROPOSAL TO RATIFY THE APPOINTMENT OF BDO, AS

THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

TO AUDIT THE FINANCIAL STATEMENTS OF THE

CORPORATION FOR THE 2015 FISCAL YEAR.

IT IS INTENDED THAT PROXIES SOLICITED HEREBY WILL BE VOTED “FOR” THE

RATIFICATION OF THE APPOINTMENT OF BDO USA, LLP, AS THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM TO AUDIT THE

FINANCIAL STATEMENTS OF THE CORPORATION FOR

THE 2015 FISCAL YEAR UNLESS THE STOCKHOLDER SPECIFIES OTHERWISE.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS, DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information as of May 21, 2015 (or such other date specified) with respect to (A) the beneficial ownership of Common Stock or shares acquirable within 60 days of such date by (i)directors. At each person known by the Corporation to own more than 5% of the Common Stock and who is deemed to be such beneficial owner of Common Stock under Rule 13d-3(a)(ii); (ii) each person who is a director of the Corporation or a nominee for director of the Corporation; (iii) each named executive in the Summary Compensation Table and (iv) all persons as a group who are executive officers and directors of the Corporation, and (B) the percentage of outstanding shares held by them on that date:

| | | |

Name, Status and Mailing Address | Number of Shares Beneficially Owned | | Percent Of Class (%) |

5% Stockholders: | | | |

Gabelli Funds, LLC One Corporate Center Rye, NY 10580-1434 | 425,860 | (1) | 25.0 |

Retop Industrial (Hong Kong) Limited Unit 27, 13/F Shing Yip Industrial Building 19-21 Shing Yip Street, Kwun Tong, Kowloon, Hong Kong | 366,666 | (2) | 21.1 |

Carlisle Investments Inc. Trident Chambers Wickhams Cay P.O. Box 146 Road Town, Tortola, British Virgin Islands | 180,366 | (3) | 10.6 |

Bard Associates, Inc | 104,480 | (4) | 6.1 |

135 South LaSalle Street, Suite 3700 Chicago, IL 60603 |

| |

|

Non-Employee Directors: | | | |

Marco Elser | 192,389 | (5) | 11.3 |

Alan K. Greene | 8,333 | | * |

George W. Schiele | 47,073 | (6) | 2.8 |

Yaozhong Shi | 366,666 | (7) | 21.1 |

Salvatore J. Zizza | 6,620 | (8) | * |

| | | |

Named Executive Officers: | | | |

J.M. Allain | 2,144 | | * |

Robert J. Conologue | - | | * |

Alberto Shaio | 8,333 | | * |

Alexandro Gomez | - | | * |

Todd Dupee | - | | * |

All directors and executive officers as a group | 631,558 | (9) | 36.2 |

*Represents less than 1% of total number of outstanding shares.

(1) | | Based on Schedule 13D, as amended, dated August 19, 2014 by Mario J. Gabelli, Gabelli Funds, LLC, Teton Advisors, Inc., Gamco Investors, Inc., GGCP, Inc., and Gamco Asset Management Inc., which companies are parent holding companies and/or registered investment advisers. All securities are held as agent for the account of various investment company fund accounts managed by such reporting person. Except under certain conditions, Gabelli Funds, LLC has sole voting power and sole dispositive power over such shares. On January 27, 2015, Gabelli Equity Series Funds, Inc. – The Gabelli Small Cap Growth Fund filed a Schedule 13G relating to 404,180 of the aforementioned 425,860 shares. |

(2) | | The amount includes 33,333 shares of Common Stock acquirable upon exercise of vested warrants. Mr. Shi, a director of Trans-Lux Corporation, is a director of Retop Industrial (Hong Kong) Limited. |

(3) | | Based on Schedule 13D dated June 20, 2014. Mr. Elser, a director of Trans-Lux Corporation, exercises voting and dispositive power as investment manager of Carlisle Investments Inc. |

(4) | | Based on Schedule 13G dated February 13, 2015. Bard Associates, Inc. has sole voting power over 12,280 of such shares and sole dispositive power over all of such shares. |

(5) | | The amount includes 190,244 shares of Common Stock owned by Carlisle Investments, Elser & Co. and Advicorp plc, of which Mr. Elser exercises voting and dispositive power as investment manager. |

(6) | | The amount includes 6,620 shares of Common Stock acquirable upon exercise of 6,600 vested warrants and 20 stock options. This amount does not include 13,400 shares of Common Stock acquirable upon exercise of warrants that are not yet vested or exercisable. |

(7) | | The amount includes 333,333 shares of Common Stock owned by Retop Industrial (Hong Kong) Limited and 33,333 shares of Common Stock acquirable upon exercise of vested warrants owned by Retop Industrial (Hong Kong) Limited. |

(8) | | Mr. Zizza disclaims any interest in the shares set forth in footnote 1 above. The amount includes 6,620 shares of Common Stock acquirable upon conversion of 6,600 vested warrants and 20 stock options. This amount does not include 13,400 shares of Common Stock acquirable upon exercise of warrants that are not yet vested or exercisable. |

(9) | | The amount includes 46,573 shares of Common Stock, as set forth in footnotes above, which members of the group have the right to acquire upon exercise of stock options and warrants. This amount does not include 26,800 shares of Common Stock acquirable upon exercise of warrants that are not yet exercisable. |

MEETINGS OF THE BOARD OF DIRECTORS AND CERTAIN COMMITTEES

The Board of Directors held five (5) meetings during 2014 and seven (7) meetings during 2013. All directors attended 75% or more of such meetings and of the committee meetings for which they were members. The Corporation does not have a formal policy regarding directors’ attendance at annual stockholders meetings, but strongly encourages and prefers that directors attend regular and special Board meetings as well as the Annual Meeting of Stockholders, in person, although attendance by teleconferenceone class of directors is elected to a term of three years or until the election and qualification of their successors, or their earlier death, resignation or removal. There are no family relationships among any of our directors or executive officers.

Independent Directors

While the Company’s common stock is traded on the OTCQB, the Company follows the NYSE MKT Company Guide regarding the determination of independence of the Company’s directors. A director is considered

adequate. The Corporation recognizesindependent if the Board determines that

attendancethe director does not have any direct or indirect material relationship with the Company. Mr. Allain and Mr. Shaio are employees of the

board members at all meetings may not be possibleCompany and

excuses absences for good cause.Non-employeetherefore have been determined by the Board to fall outside the definition of “independent director.” Messrs. Elser, Greene, Morris, Schiele, Shi and Zizza are non-employee directors (other than our Chairman and Vice Chairman) are due to receive an annual fee of $10,000, as well as $1,000 for each meeting of the Board attended in personCompany. Mr. Elser, via Carlisle Investments, Inc. (“Carlisle”) over which he exercised voting and $500 for each telephonic meeting attended, while employee directors are not entitled to receive any fees for their attendance to any meetings or otherwise. Mr. George Schieledispositive power as investment manager, and Mr. Salvatore Zizza,Schiele have made loans to the ChairmanCompany and Vice Chairman, respectively, receive an annual fee of $15,000 each, monthly fees of $3,000 each, $1,500 for each meeting oftherefore have been determined by the Board attended in personto fall outside the definition of “independent director.” Mr. Shi is a Director of Transtech, which is the Company’s main supplier of LED modules and $750 for each telephonic meeting attended. Fees fortherefore has been determined by the Board to fall outside the definition of “independent director.”

The Board has determined that Messrs. Greene, Morris and Zizza are “independent directors” because they had no relationship with the Company other than their capacities as members of the Board and Committeescommittees thereof. The Board has determined that its two Audit Committee members, Messrs. Greene and Zizza, are determined annually“independent directors”. In addition, our Board has made a subjective determination as to each independent director and independent director nominee that no relationships exist which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our Board reviewed and discussed information provided by the entiredirectors, the director nominees and us with regard to each director and director nominee’s business and personal activities and relationships as they may relate to us and to our management. In addition, our Board has concluded that each of Directors basedMessrs. Greene and Zizza satisfies the heightened audit committee independence standards set forth in Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Board Committees

Our Board has established a standing Audit Committee, Compensation Committee, Executive Committee and Nominating Committee. Each committee operates under a charter approved by our Board. Copies of each committee’s charter are posted on the Investor Relations section of our website at www.trans-lux.com.

Audit Committee

Our Audit Committee consists of Messrs. Greene and Zizza, with Mr. Zizza serving as chairman. Our Board has determined that Mr. Zizza is an “audit committee financial expert” as defined in applicable SEC rules. Our Audit Committee’s responsibilities include:

appointing, compensating, retaining and overseeing the work of any public accounting firm engaged by us for the purpose of preparing or issuing an audit report or performing other audit, review or attest services;

reviewing and discussing with management and the external auditors our audited financial statements;

considering the effectiveness of compensation paid by other similar size companies,our internal control system;

reviewing and discussing with management the amounts currently paid by the Company, the overallCompany’s major financial risk exposures and steps management has taken to monitor and control such exposures and liabilities;

establishing our policy

for determining compensation paid to officers andregarding our hiring of employees or former employees of the

Companyexternal auditors and

the general financial condition of the Company. During 2014 and 2013, certain board members deferred payment of their fees. In lieu of a cash payment, certain board members and former board members have agreed to receive restricted shares of Common Stock of the Company or a combination of cash and restricted shares of Common Stock of the Company, which such restricted shares shall contain a legend under the Securities Act of 1933, as amended (the "Securities Act") and shall not be transferable unless and until registered or otherwise in accordance with applicable securities laws. Certain of these restricted shares were issued in December 2013.

Corporate Governance Policies and Procedures

The Board of Directors has adopted a Code of Business Conduct and Ethics Guidelines (the “Ethics Code”) that applies specifically to board members and executive officers. The Ethics Code is designed to promote compliance with applicable laws and regulations, to promote honest and ethical conduct, including full, fair, accurate and timely disclosure in reports and communications with the public. The Ethics Code is available for viewing on the Corporation’s website at www.trans-lux.com. Any amendments to, or waivers from, the Ethics Code will be posted on the website. In addition, the Board of Directors adopted a Whistle Blowing policy, which provides procedures for the receipt, retention and treatment of accounting related complaints receivedand concerns;

meeting independently with our external auditors and management;

reviewing and updating the Audit Committee Charter; and

preparing the Audit Committee report required by the

Corporation regarding accounting, internal accounting controls and auditing matters, as well as the confidential, anonymous submission of concerns regarding questionable accounting or auditing practices.Corporate Leadership Structure

Two separate individuals serve as the Corporation’s Chairmanproxy rules of the Board and Chief Executive Officer. The Chairman is not an executive officer. The Chairman provides leadership to the Board in the fulfillment of his responsibilities in presiding over Board meetings. The Chairman also presides over all meetings of the stockholders. The Chief Executive Officer is responsible for directing the operational activities of the Corporation.

Risk Management

SEC.

Compensation Committee

Our

Board of Directors and its Audit Committee are actively involved in risk management. Both the Board and Audit Committee regularly review the financial position of the Corporation and its operations, and other relevant information, including cash management and the risks associated with the Corporation’s financial position and operations.Communication with the Board of Directors

Security holders are permitted to communicate with the members of the Board by forwarding written communications to the Corporation’s Corporate Secretary at the Corporation’s headquarters in New York, New York. The Corporate Secretary will present all communications, as received and without screening, to the Board at its next regularly scheduled meeting.

Committees of the Board of Directors

The Board of Directors has appointed a Compensation Committee an Audit Committee, an Executive Committeeconsists of Messrs. Elser, Greene and a Nominating Committee.

Zizza, with Mr. Greene serving as chairman. Our Compensation Committee

TheCommittee’s responsibilities include:

providing guidance and periodic monitoring for all of our corporate compensation;

considering the effectiveness of our employee equity programs;

administering our stock incentive plans with respect to our executive officers and employee Board members, including the adjustment of the Compensation Committee ofbase salary each year;

implementing and administering our incentive compensation programs and authorizing all awards under these incentive programs;

administering our employee benefit plans; and

approving all perquisites, equity incentive awards, special cash payments or loans made or paid to executive officers and employee Board members and assisting the Board of Directors are Messrs. Elser, Greenein succession planning for executive officers.

At the end of each fiscal year, the Compensation Committee meets to review the performance of executive officers and Zizza.employee Board members subject to the short-swing profit restrictions of Section 16 of the Exchange Act under those programs and award bonuses thereunder. At that time, the Compensation Committee may also adjust base salary levels for executive officers and employee Board members subject to the short-swing profit restrictions of Section 16 of the Exchange Act and review the overall performance of our employee benefit plans. The Compensation Committee operates under a formal written charter approved by the Compensation Committee and adopted by the Board of Directors. also meets when necessary to administer our stock incentive plan.

The Compensation Committee reviewshas determined and reviewed the value and forms of compensation for our named executive officers and other benefits.officers based on the committee members’ knowledge and experience, competitive proxy and market compensation information and management recommendations. The Compensation Committee did not hold any meetingsengage a compensation consulting firm in 2014 or 2013. Nonefiscal year 2015. The Compensation Committee does not delegate its authority to review, determine and recommend, as applicable, the forms and values of the membersvarious elements of thecompensation for executive officers and directors. The Compensation Committee is or has been an officer or employee ofdoes delegate to Company management the Corporation. There are no Compensation Committee interlock relationships with respectimplementation and record-keeping functions related to the Corporation. Membersvarious elements of saidcompensation it has approved.

Nominating Committee receive

Our Nominating Committee consists of Messrs. Elser, Schiele and Shaio. Our Nominating Committee’s responsibilities include:

reviewing any stockholder nominations for directors and presenting to our Board a feelist of $320individuals recommended for eachnomination for election to our Board at the annual meeting of stockholders;

reviewing the Committee they attenddisclosure included in our proxy statement regarding our director nomination process;

reviewing the composition of each Board committee and presenting recommendations for committee memberships to our Board as needed; and

reviewing the

Chairperson, Mr. Greene, receives an annual feecharter and composition of

$1,600.

Audit Committee

The memberseach Board committee and making recommendations to our Board for the creation of additional Board committees or the Audit Committeechange in mandate or dissolution of the Board of Directors are Messrs. Zizza and Greene. The Audit Committee operates under a formal written charter approved by the Committee and adopted by the Board of Directors, a copy of which is available on the Corporation’s website at http://www.trans-lux.com/about/investor-information. The Board of Directors has determined that Mr. Zizza meets the definition of “audit committee financial expert” set forth in Item 407 of Regulation S-K, as promulgated by the SEC. The Audit Committee held five (5) telephonic meetings with the independent auditors in 2014 and two (2) such meetings in 2013. The responsibilities of the Audit Committee include the appointment of the independent registered public accounting firm, review of the audit function and the material aspects thereof with the Corporation’s independent registered public accounting firm, and compliance with the Corporation’s policies and applicable laws and regulations. Members of said Committee receive a fee of $400 for each meeting of the Committee they attend (other than the quarterly telephonic meetings held with the independent auditors) and the Chairman, Mr. Zizza, receives an annual fee of $2,400 and a fee of $100 for his participation in each quarterly telephonic meeting held with the independent auditors.

committees.

Executive CommitteeThe members of the

Our Executive Committee consists of the Board of Directors are Messrs. Elser, Schiele and Zizza. The Executive Committee operates under a formal written charter approved by the CommitteeMessrs. Schiele and adopted by the Board of Directors. Mr. Zizza isare independent, in accordance withmeeting the requirements of Section 952 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Each of the members of the Executive Committee qualify as "non-employee directors"“non-employee directors” for the purposes of Rule 16b-3 under the Securities Exchange Act, of 1934,and Messrs. Schiele and Zizza qualify as amended (the "Securities Exchange Act"), and Mr. Zizza is an "outside director"directors" for the purposes of Section 162(m) of the Internal Revenue Code, as amended. The primary purpose of theOur Executive Committee is to provide the President and Chief Executive Officer of the Company with a confidential sounding board for insights and advice, and to provide the Board with a more active formal interface with management and its day to day policy and actions. Additionally, the secondary objective of the Executive Committee is to exercise the powers and authority of the Board, subject to certain limitations set forth in the charter, during the intervals between meetings of the Board, when, based on the business needs of the Company, it is desirable for the Board to meet but the convening of a special board meeting is not warranted as determined by the Chairman of the Board. Committee’s responsibilities include:

| · | providing the President and Chief Executive Officer of the Company with a confidential sounding board for insights and advice, and to provide the Board with a more active formal interface with management and its day to day policy and actions; and |

| · | exercising the powers and authority of the Board, subject to certain limitations set forth in the Company’s charter, during the intervals between meetings of the Board, when, based on the business needs of the Company, it is desirable for the Board to meet but the convening of a special board meeting is not warranted as determined by the Chairman of the Board. |

It is the general intention that all substantive matters in the ordinary course of business be brought before the full Board for action, but the Board recognizes the need for flexibility to act on substantive matters where action may be necessary between Board meetings, which, in the opinion of the Chairman of the Board, should not be postponed until the next previously scheduled meeting of the Board. Members

Directors’ Attendance at Meetings

During fiscal year 2015, the Board and each of its committees held the following meetings:

the Board held five meetings;

the Audit Committee held four telephonic meetings;

the Compensation Committee held one meeting;

the Nominating Committee held [__] meetings; and

the Executive Committee did not hold any meetings.

In fiscal year 2015, all directors attended 60% or more of meetings of the Board and committees on which they serve. The Company does not have a formal policy regarding directors’ attendance at annual stockholders meetings, but strongly encourages and prefers that directors attend regular and special Board meetings as well as the annual meeting of stockholders in person, although attendance by teleconference is considered adequate. The Company recognizes that attendance of the Board members at all meetings may not be possible and excuses absences for good cause.

Board Leadership Structure

The roles of Chairman and Chief Executive Officer are separate positions. Mr. Schiele serves as our Chairman and Mr. Allain serves as our Chief Executive Officer. We separate the roles of Chairman and Chief Executive Officer in recognition of the differences between the two roles. The Chief Executive Officer is responsible for setting our strategic direction and our day-to-day leadership and performance, while the Chairman of the Board provides guidance to the Chief Executive Officer and presides over meetings of the Board. We do not receive any feeshave a lead independent director.

Risk Oversight

Our Board of Directors and its Audit Committee are actively involved in risk management. Both the Board and Audit Committee regularly review the financial position of the Company and its operations, and other relevant information, including cash management and the risks associated with the Company’s financial position and operations. The Board regularly receives reports from senior management on areas of material risk to our Company, including our liquidity, operational and legal and regulatory risks. Pursuant to its charter, the Audit Committee reviews our major financial risk exposures and the steps management has taken to monitor and control such exposures, and it also meets periodically with management to discuss policies with respect to risk assessment and risk management.

Nominations for

their participation.Directors

Director Qualifications

The full Board is responsible for selecting persons to fill vacancies on the Board and recommending candidates for election by the stockholders. The Board has delegated the process of considering candidates to the Nominating

CommitteeThe members ofCommittee. In evaluating director nominees, the Nominating Committee of the Board of Directors are Messrs. Schiele, Elser and Shaio. The Nominating Committee operates under a formal written charter approved by the Committee and adopted by the Board of Directors. The Nominating Committee recommends for consideration by the Board of Directors,considers director nominees for election of directors at the Corporation’s Annual Meeting of Stockholders. Director nominees are considered on the basis of, among other things, experience, expertise, skills, knowledge, integrity, understanding the Corporation’sCompany’s business and willingness to devote time and effort to Board responsibilities. Members of

In assessing potential new directors, the Nominating Committee

do not receive any fees for their participation.considers individuals from various disciplines and diverse backgrounds so that the Board has a broad diversity of experience, professions, skills and backgrounds. The Nominating Committee does not

have a separateassign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. Our Board has no formal policy

regardingwith regard to the consideration of diversity

in identifying director nominees, but the Board believes that the backgrounds and qualifications of the

Board.

Corporate Governance Committee

The Boarddirectors, considered as a group, should provide a composite mix of Directors has not established a corporate governance committee. The Board of Directors acts as the corporate governance committee.

Independence of Non-Employee Directors

The Corporation follows the NYSE MKT Company Guide regarding the independence of directors. A director is considered independent if the Board of Directors determinesexperience, knowledge and abilities that the director does not have any direct or indirect material relationship with the Corporation. Mr. Allain and Mr. Shaio are employees of the Corporation and therefore have been determined bywill allow the Board to fall outsidefulfill its responsibilities. Other than the definitionforegoing, there are no specific minimum qualifications that the Nominating Committee believes that a Committee-recommended nominee to the Board must possess, although the Nominating Committee may also consider such other factors as it may deem are in our best interests or the best interests of “independent director.” Messrs. Elser, Greene, Schiele, Shi and Zizzaour stockholders. Nominees are non-employee directorsnot discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

In its deliberations, the Nominating Committee is aware that our Board must have at least one director who qualifies as an “audit committee financial expert” as defined by SEC rules. The Nominating Committee also believes it appropriate for certain key members of our management to participate as members of the Corporation. Mr. Elser, via Carlisle Investments, Inc. over which he exercises votingBoard.

Stockholder Nominations

The Nominating and dispositive power as investment manager, and Mr. Schiele have made loansCorporate Governance Committee will evaluate any director candidates recommended by a stockholder according to the Corporation and therefore have been determinedsame criteria as a candidate identified by the BoardNominating Committee.

Any stockholder who intends to

fall outsidenominate a director at our 2016 Annual Meeting must notify our Corporate Secretary in writing at the

definitionaddress set forth at the beginning of

“independent director.” Mr. Shi isthis proxy statement of such intent in a

Directortimely manner in accordance with Article 5(c) of

Retop Industrial (Hong Kong) Ltd., which isour Amended and Restated Bylaws. In accordance with the

Corporation’s main supplieradvance notice provisions of

LED modules,our Amended and

therefore has been determinedRestated Bylaws, to be timely, director nominations must be delivered to or mailed and received by the

Board to fall outsideCorporate Secretary of the

definitionCompany not later than the close of

“independent director.” The Board of Directors has determined that Messrs. Greene and Zizza are “independent directors” since they have no relationship with the Corporation other than their status and payment as non-employee directors and as stockholders. The Board of Directors has determined that its Audit Committee members, namely Messrs. Greene and Zizza, are “independent directors”.Non-Employee Director Stock Option Plan